Over the last couple of years, we’ve been sharing some really interesting insights from different online brokers. And today we interviewed another with our Quiet Light Review. We’re really excited to share this because we want to show you what the possibilities are for online businesses that are selling for millions of dollars.

Mark Daoust is the founder and CEO of Quiet Light, who works with business owners of SaaS, e-commerce, Amazon, and of course (our favourite!) Content-based websites. Since starting in 2007, Quiet Light has been the broker to over 600 online business sales, totalling over $300 million in transaction value.

Today, Mark shares with us some really interesting factors that are driving this massive online growth. He shows us how the market is really hot right now for sub million-dollar businesses. What’s really exciting is that these are online businesses just like what Liz and I teach you.

We can’t underestimate right now just how much opportunity there is out there for online businesses. This is a marketplace that’s really maturing, and has a lot more institutional investors piling in cash. So, where do you want to sit in this wave of growth?

To find out more, watch the interview with Mark, or read the transcript below.

Liz Raad: Hello. Today, we are very excited to welcome a special guest, Mark Daoust. Mark is the founder and CEO of Quiet Light Brokerage, which specializes in multimillion dollar website sales.

We’re very excited to have you here, Mark. What we’d love to do is get some of your insights into the market right now, and potentially some opportunities that you’re seeing. So thank you so much for being with us.

Matt Raad: Yes, a big thank you for coming along.

Mark Daoust: Thanks so much for inviting me into your community. I’m really excited to be here talking to you guys. It’s going to be a fun conversation. I’m honoured to be invited.

Liz: Yes, I think it’s going to be a great conversation, because there is some exciting stuff happening in website world, isn’t there?

Mark: Absolutely.

Our Quiet Light Review shows that 2021 is a Seller’s Market

Liz: What are you seeing at the moment? We know that you’ve grown your brokerage phenomenally over the last 14 years. What’s the biggest trends that you’re seeing over that time, certainly in terms of growth of valuations, or even just the overall market?

Mark: As of 2021, I’ve been doing this for 14 years. And I can easily say, this is the hottest market I’ve seen in these 14 years.

To give you a barometer of that – in June 2021, I’m going to have one person close roughly $25 million worth of transactions for the month. Now, if you go back to 2014 and 2015, we did $17 million for the year as a company. So, there is massive growth in this space, and obviously the company itself is growing extraordinarily rapidly.

We’ve been doing this for a long time. But right now, it’s been like a witches’ brew of perfect things coming together to create this incredible concoction that we have, which is a really hot marketplace.

And it’s definitely a seller’s market right now. It won’t last forever. Nothing like this does, but I think there’s a lot of trends that maybe we can take away from this, as far as what does it look like going forward right now. And also, maybe when there’s a pull back and also what’s going into some of these trends etc.

Mark from Quiet Light reveals how the 2020 Pandemic has fuelled massive online growth

Liz: We’d love to have your insight. Do you have a feeling what’s driving this growth? What are the factors? Why is this happening?

Matt: Yes Mark, because you get to see behind the scenes. You’re working with these presumably big buyers. What’s driving it, particularly over this last 1-2 years?

Mark: Well again, there’s a lot of things that have come together that have created this explosion in the marketplace. One of the things has been the pandemic. For most businesses, the pandemic has been really bad. But, for the online world, it’s been very good because people were home.

I’m not revealing anything new here, but this has resulted in a lot of people moving to online shopping habits and moving towards more online behaviour. Zoom is a household name, whereas a year ago (before the pandemic), it was not. It was well-known in business circles, but it certainly wasn’t a household name.

We always knew the online world was going to gain further adoption. What the pandemic did is it took a cinder block and stomped on the accelerator and didn’t let go. Now we need to wait and see, because the pandemic across much of the world is starting to subside. There are still hotspots as we’re having this conversation, but we’re starting to see the light at the end of the tunnel.

Institutional investors are also contributing to the increased growth in online business valuations

Mark: So what does the world look like post-pandemic? Well, according to everyone that I talk to (and it’s my opinion as well), is that we’ll see some kind of a drawback. The floor is significantly higher. User adoption, user comfort of the online world is much higher than it was pre-pandemic. That part’s not going away. So, what will cause this boom?

- Businesses have grown like crazy.

- We’re seeing institutional money.

Prior to the pandemic, we were already seeing institutional money increasingly cast its gaze over at the online world. Previously it had cast its gaze pretty skeptically:

- How do we size these businesses up?

- How stable are they?

- How do we assess them?

- How do we grow them?

More Institutional money being spent in certain online businesses sectors – including Content-based Websites

Mark: There was certain marketplaces or certain verticals like SaaS that were getting institutional money and were growing rather quickly. But the other areas like content businesses, Amazon businesses etc. still had some skepticism. And that icy look at the market was fine before. But boy, it’s gone now! The institutional money is looking at it saying, “There is money here.”

If we just look at the FBA space with Amazon, we’re seeing right now over $4 billion raised in a short amount of time for that one little sector alone. Perch just recently raised $750 million in their latest round. Thrasio was the fastest company ever to a billion-dollar valuation. And it’s because they’re looking at this with the pandemic and with this acceleration of the online world; plus a better sense for how to value these businesses and what makes them sustainable. And a certain maturity in the marketplace.

All these things have gone together and have caused an explosion of buying activity, which has resulted in multiples being pushed up slightly, a lot more competitiveness on the deals, and again, a good environment for sellers.

A Maturing Online Marketplace provides us with a Massive Opportunity

Mark: Now I will add an asterisk here. These are not the highest multiples we’ve seen. The higher multiples were frankly around the turn of the century. When I started Quiet Light, higher multiples existed, but that was a lot of ignorance, frankly. It was people not knowing how to value these businesses. Then we went through the great recession.

And then we also combined that for people in the content space and SEO space. Google algo updates, we learned very quickly just how dangerous those can be. And then we got familiar with social media and what a great source of traffic it is. And then all of a sudden, “Oh, maybe this isn’t the greatest platform to build an entire business on entirely”.

And so, there was a lot of adjustment over these years where we’re growing and maturing as businesses. We’re not there yet, of course. We’re still on the train, but we’re a lot further along than we were 10 years ago.

We’re now seeing more stability – the highs and lows of Search Engine updates aren’t as extreme as they used to be

Liz: I often think about it like the Wild Wild West. Each element has to go through its Wild Wild West moment like you were referring to there. There was the Google Wild Wild West, when you never quite knew what was going to happen. There’s been the Amazon Wild Wild West, and then everything’s maturing and it’s more stable. So you’re more sure now that if you buy one of these businesses, you can continue, and there is more stability showing.

Mark: I’ve been online long enough to remember when the Google updates were the biggest event of the month. And people would be waiting for them – fortunes were made and lost based on those updates. It was a fun time.

Liz: You say fun. I guess it depends! 🙂

Mark: Yes, fun if you were on the right side. Otherwise, it could be really devastating. I had sites that were doing really well that got wiped out in a day and that was the whole world. But it’s maturing. I mean, our relationship with the online world is in its infancy still. We’re all still figuring this out, but we’ve come a long way.

And so to your original question, what’s caused it? It’s all these things going together.

Liz: It’s the perfect storm.

Mark: It is. It’s the perfect storm.

Quiet Light explains which Websites have the Highest Sale Multiples

Liz: You’re seeing this all come together, and you’ve seen it evolve over this time. Which online business models do you see are selling the fastest or for the highest multiples? What are the ones that really stand out?

Mark: SaaS has traditionally had the best multiples.

Liz: For our readers, this means Software as a Service.

Mark: So, if we were to break up (and maybe this is an unfair way to break this up, but I think it works pretty well), there’s 4 categories here:

- E-commerce: anything where you’re selling physical products.

- Content: which would be obviously ads or selling some form of digital content.

- Software as a Service

- Productized Service

Matt: Content’s my favourite.

Mark: I love it too. It’s where I got my start.

Software as a Service has traditionally had the highest multiples out of this entire group. Content is up there as well and tends to receive some pretty high multiples (and sometimes outsized multiples).

E-commerce tends to have the tightest multiple ranges. In other words, when we look at a scatter chart on where these things are being sold, e-commerce tends to be pretty well tied together and well defined. SaaS can have crazy high multiples, and others can be really low or unsellable. It spreads out pretty wide, and this is the same with content as well.

So traditionally, that’s what we’re seeing right now when it comes to multiples. But it transcends the business model, to be honest. We’re all looking for sustainability and growth. And so I would urge people thinking about this, not to think in terms of, “I’ve got to start an e-commerce business, it’s hot. FBA is hot. I’ve got to do that”.

People care about what is going to be sustainable and what can grow. That’s always going to be there. That doesn’t change.

Liz: I totally agree with that.

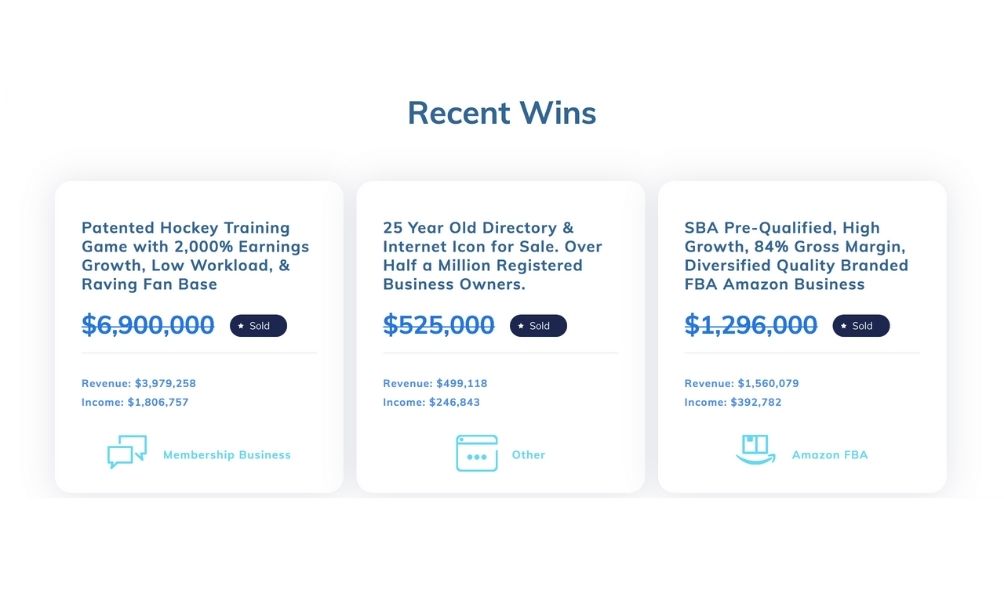

What is the Price Range of the Quiet Light Marketplace?

Matt: Quiet Light specializes in selling multi-million-dollar websites. But what’s the general range of valuations for websites that you’re selling? Also, what’s the sweet spot for your buyer marketplace – are we talking $1 million, $5 million, $20 million websites? And has that changed in the last 12 months?

Mark: Yes, it’s changed in the last 12 months. We’re knocking on the door of the lower middle market, which would be $10 million, $15 million, $20 million, $25 million transactions. We’ve done transactions in that size range.

Most of our team love doing $1 million to $5 million transactions. They’re a lot of fun to do. The buyer market is very strong in the sub million-dollar range. So it’s hard to tack down where we would specialize.

I would generally say $250,000 to $25 million. But, even with the $25 million, that’s a bit of a false ceiling until we do something higher. Because frankly, a buyer who can do a $25 million transaction often can do a $40 million transaction. And the guys who can do a $40 million transaction can probably do a $75 million etc.

It expands pretty rapidly when you get up into the middle market as far as capabilities. But where are we doing deals right now? Our median price is about $1.8 million. A scatter chart would probably show some decent concentration in the high six-figure space, between the $1 million to $5 million range. But that’s been rapidly changing.

Quiet Light shares their insights of current online Trends and Opportunities

Liz: That’s very interesting. So, just say you were to start over right now and want to build a business in order to sell. Are there any trends or opportunities that you’re seeing coming through right now that would be good for the future? Do you have any insights in that? If you were to start, would there be a particular business or website that you would go with? Or a particular topic or niche?

Mark: There is, but it wouldn’t be necessarily because I see it as the most appealing category. Let me answer personally versus where I see the opportunities.

Mark’s personal lesson from online business ownership is to Keep it Simple

Personally, I’m at a place right now with Quiet Light, where we’re growing rapidly, and our team is expanding. It’s a lot of fun, but it’s also a lot of stress. And personally, I desire and crave some of the simplicity of the earlier days.

So if I were to build something from scratch, I’d probably have an emphasis on simplicity because I like that. Not that it’s not fun right now (it is). But it has been a lot of work to get here and the next stages are also a lot of work. It’s a ride that I think I’m only going to enjoy riding once. So that’s personal.

Websites based around Hobbies can make a lot of Passive Income Online

Mark: As far as what are we seeing in the marketplace? What are the things that are really appealing? The things that I often point people to would be the hobbies that people have, and what people love the most. Pets is a good example of this. My goodness, pets has always been popular!

Matt: Yeah, huge.

Mark: People love their pets. And right now, there’s firms out there that are specifically looking for pet-based businesses. You can expand beyond that. You can expand into other hobbies.

So the second business I ever sold was selling aftermarket parts for Jeeps for people that were doing off-roading in Jeeps. Those sorts of industries have a lot of interest because people spend on their hobbies and they spend wildly at times. So there’s always interest in that.

A sustainable online business should have ongoing recurring income

The other characteristics that buyers love would be recurring revenue elements. So, subscription-based businesses that have good metrics or consumable products. Supplements is a very popular category. It’s got this love-hate relationship. Buyers either want it, or they want to avoid it. There’s not a lot of people that say, “Well, I’ll look at it because it’s super competitive”. But if you’re in the space and you know what you’re doing, it’s highly desirable.

You can expand beyond this into consumables. If you have a product that people grow loyal to, but then have to continually reorder, that’s a good thing as well. So those are some ways that I like to think about it.

I love hobby niches, like equestrian. We had this business for a while where we were selling a bunch of equestrian sites – horse lovers, saddles, classifieds, things like that. The interest we got on those was outsized because every buyer out there that had an equestrian hobby was like, “Yes, I want it!” So, I love looking at the hobbies.

But then the other elements would be just that recurring predictable income. With the business model itself, content and SaaS always get the attention. Content gets the attention because of really high margins. SaaS gets the attention because of the recurring revenue and the ability to expand and build on that recurring revenue.

Liz: That is awesome.

Matt: That is fantastic.

Liz: That’s a really good way of looking at the marketplace. It gives you a different perspective of how you’re choosing businesses and niches.

Matt: And thank you, Mark, for mentioning the equestrian niche! I have been constantly saying this to our high-level coaching clients here in Australia. Someone should do a big horse site here in Australia. We’ll sell it for millions. There you go, guys. You’ve just heard it from Mark himself. But I’ve loved the reason too because the buyers are all into horses.

More people are turning to online businesses for additional income

Mark: When you’re looking at sub $5 million, you’re appealing mostly to individuals. A very common profile of a buyer at that price range would be the executive who’s maybe put in 30 years at a C-level job and is now thinking, “You know what I want to do? I want to buy an RV and travel the country. I have enough to retire on, but I’d like an additional income. I still want to do something”. And so, they buy an online business because it gives them lifestyle flexibility while still giving them the ability to exercise those business muscles that they’ve developed over the years.

The Difference between Selling to Individual vs Corporate

Liz: Would you say that’s an easier sale process to sell to an individual, rather than to a big corporate or private equity?

Mark: Yes, it can be. Most of the time it is.

The benefit of selling to a corporate entity is the lack of emotion. Where that can be an advantage is when there’s a problem, you can usually address the problem, and they’ll just look at it at face value.

When you’re dealing with a buyer who’s an individual (and who is maybe putting their retirement funds etc. into it), it becomes much more emotional. There’s a lot more defences that they put up to protect themselves. So that part can be a little bit more difficult.

Where it’s more difficult to sell to a corporate entity is, they are much more thorough. Their due diligence digs deep. I mean, really, really deep, to the point of being painful and long. You can’t believe how much work it is until you’ve been through it.

Matt: We can believe it. We used to sell businesses to private equities.

Liz: And then they start to do the EBIT grind. And the deal’s almost there and then suddenly, it’s not.

Matt: And then there’s another six months of due diligence that we need to do. And they say, “We need to go back over this” and, “Please send us a folder of this” etc. But I’d like to think that websites are way easier than that?

Mark: They are. Comparatively speaking, they are.

If you’re selling a $15 million business, you’re still going to have a deep due diligence. The process with a private equity (like when we did a few $20 million+ transactions), the due diligences on those took between 4 and 6 months to complete, beginning to end.

Matt: Yes, so similar to a bricks and mortar business.

Websites under $1 million on the Quiet Light platform are Selling Fast

Matt: So, I’m just thinking of our community of readers here, who have sites under the sub-mil range, say $250,000 to $1 million. When you list these, how quickly are they selling? If they want to sell a website through you guys, what would be the process? Is this a quick transaction in the current marketplace? I know that’s a long piece of string, but say it’s a genuine, real content site.

Mark: Right now, it’s pretty quick. The median time is 110 days, but if you actually plot it out, it looks like a two-humped camel. If you take a look at it on a per-day basis, there’s a collection right around 45 to 60 days. You’re typically looking at 1-2 weeks to settle on an offer. And you’re usually looking at multiple offers that you get to select from.

On FBA, we’re averaging over 4 offers per closed transaction. For non-FBA, we have around 3.6 offers per closed transaction. So, it’s still pretty strong numbers there.

And then there’s due diligence. This depends on how complex the business is and the funding mechanism behind it. Sub $1 million, most buyers are bringing their own cash and that’s a pretty quick process.

For a content site, 30 days would be the expectation. We would push back on somebody who wants 60 days. 45 days would be a compromise if somebody really needs that. So, it’s a pretty quick process.

There are Cash Buyers lining up for Online Businesses valued over $1 million

Matt: Ok, that’s just brought up something interesting. I know that in America with buying and selling businesses, funding is quite different to what we have available here in Australia.

You just mentioned that for businesses under $1 mil, it’s self-funded. But once you get in that $1-5 million with those ex-corporate executives; is it easy for them to get funding for websites? What are you seeing happen in that kind of a sale range?

Mark: It’s usually still cash that they have. If it’s US-based, then we have the option of SBA financing here in the US. But the company needs US-based tax returns for that. An Australian-based company wouldn’t qualify for that, so we would need to find a buyer that has the cash.

And these cash buyers do exist. For a very long time at Quiet Light, we existed in an environment where no funding was possible because we were going through the great recession. Nobody went for online businesses. But we were still closing 7-figure transactions. So, those buyers do exist, but the volume is just lower there for that.

The Future of Buying and Selling Websites for Profit

Liz: So, what do you think the future holds? Where are we going next in website world?

Mark: As long as you take this interview down after a certain amount of time so people can’t come back and say how awful this was! 🙂

Matt: That’s what I was going to say. It’s just a fun question. We’re not going to hold you to it!

Liz: But I think there’s more growth in the market yet.

Mark: Absolutely. I think there’s more growth to be had, for sure. And we’re planning on more growth. But, I would not be surprised to see a minor pullback in buying activity. This would be as the current influx of cash settles down, and companies either exit the space or settle into a vein that makes more sense for them.

We’ve seen an influx of cash into the FBA space. The problem is there’s not that many businesses for sale. There’s around 4 billion by our count. That might be low because that figure was from a few months ago. So maybe it’s 6 billion by now? It’s a ridiculous number. There’s not $6 billion worth of businesses for sale. And these companies have to deploy that capital. That’s why they raised it. So they’re going to start looking elsewhere.

As the market matures, we’ll see sustainability in the online market

Mark: So, my guess is, there will be a pullback in buying activity, but I don’t think it’s going anywhere. I think the pullback is not going to be complete disappearance because the sector is still highly appealing. The multiples are still relatively low, especially as businesses (an acquirers) understand how to value these businesses better. If we’re looking at multiples on EBITDA of 3, 4 or 5; that’s a relatively low multiple, especially when compared with a business that gets to a certain size.

We didn’t talk about this, but this is a dynamic in this space. The larger the business, the higher the multiple, because it’s more stable business. So, main street businesses, (sub $1 million businesses) will always have relatively lower multiples.

Online Businesses will continue to grow and mature into long-term sustainable businesses

Mark: But yes, in general I think there will be an increased activity in the marketplace. This is for the viability of the marketplace and the maturation as well. From the moment I started Quiet Light, there has been a growing maturity of this market. We question, “How do you build a sustainable business in the online world?”

And that’s occurred as people have learned how to bridge the gap from the online world, into the physical world. We’re learning how to build our businesses in a way that’s more sustainable, and marrying the traditional brick-and-mortar business with the online world. And I think that process will continue, and we’ll end up with something that looks a little bit different than what we have now.

Liz: Exciting times.

Matt: That is awesome.

Did you enjoy our Quiet Light Review? Find out more about their brokerage service

Liz: Well, thank you so much for sharing those insights with us, Mark. We really appreciate you being here with us today. Now, if someone wants to find out more about Quite Light, where should they go?

Mark: Quietlight.com. Super easy. We have a podcast as well. We talk a lot about this sort of stuff. When we bring on guests, we talk about buying and selling. Sometimes we bring on old clients to talk about their process of going through this. If you’re into podcasts, then I highly encourage you to subscribe. But if you want more information, just head over to quietlight.com. We have a lot of online learning resources on the site.

Liz: That’s fantastic. Thank you so much, and hopefully we’ll be able to speak to you again soon. We’d love to hear some more of those stories.

Matt: Absolutely.

Mark: Thank you.